Alfa Insurance - Jonathan Portillo Agency Fundamentals Explained

So that requires an insurance coverage broker? If you're an university student with a single cars and truck, it's you - Insurance Agent in Jefferson GA. The least expensive quotes atop the very first page of your Google search will possibly be enough. Right here are a couple of personal and also industrial accounts that ought to have an agent: Presuming you make the appropriate decision and also opt for an you have a far better chance at conserving money.

Allow's say you acquired a house owners policy from an independent broker. Rather of starting over with an additional business, just call your broker! Your agent can aid with that also!

Alfa Insurance - Jonathan Portillo Agency - Questions

When dealing with something as delicate as insurance, favorable communications are so vital. Envision divulging delicate information or hiring the center of an emergency. If the person beyond of the phone recognizes, pleasant and has your depend on, you will certainly really feel secure. Now picture if it was a stranger - https://www.startus.cc/company/alfa-insurance-jonathan-portillo-agency...

Do not make insurance policy much more complex than it already is. To truly be on top of your insurance plan, there are many insurance policy terms, legal clauses and coverage limits you must recognize. Consider your representative like an advisor, a legal representative and a supporter. They manage every one of the facility, unfulfilling aspects of insurance in your place, while giving understanding as well as guidance when necessary (https://codepen.io/jonfromalfa1/pen/abQeRjB).

Alfa Insurance - Jonathan Portillo Agency Things To Know Before You Get This

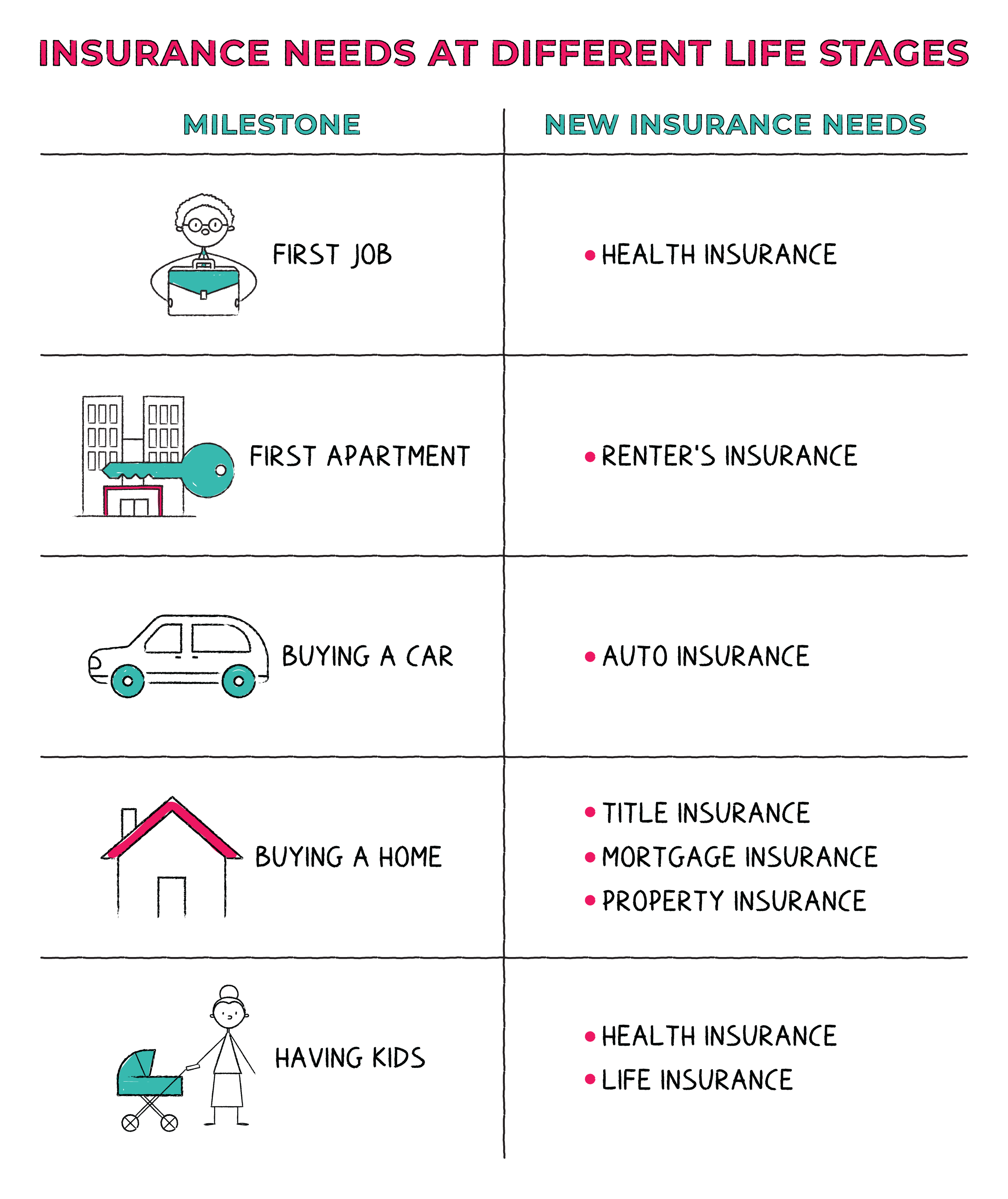

Insurance can be a difficult purchase. You're not getting bread or milk. You're acquiring a promise of security that can possibly make or break your economic wellness. Just how do you understand that you're making the right choices about insurance coverage? Are you sure you're getting the most effective feasible worth for your dollar? The options can appear overwelming.

We've seen first-hand exactly how the suggestions as well as campaigning for of representatives benefit our insurance holders. Below are 7 reasons we believe the independent firm experience advantages you: Independent agents stand for several various insurance provider that supply a wide array of coverage alternatives and also rate points. Most generally cost five to eight various insurance policy companies.

Consider it. While you might research wording for wills online, you'll likely most likely to a lawyer to guarantee that the paper is created appropriately. Why wouldn't you look for the recommendations of a qualified insurance expert to be specific that your residence, your automobile, or your organization is effectively secured? Representatives not only locate you competitive pricing, they see to it you are appropriately covered.

The smart Trick of Alfa Insurance - Jonathan Portillo Agency That Nobody is Discussing

An independent representative deals with numerous insurance policy companies to use a wider series of insurance products to fulfill consumer requirements. They are additionally able to provide comparable insurance products across a broad variety of companies. Restricted representatives work with simply one insurance firm, using just the products provided by that certain firm - Business Insurance Agent in Jefferson GA.

Get This Report about Alfa Insurance - Jonathan Portillo Agency

With accessibility to numerous business, the independent insurance policy representative can his explanation inspect prices and protection kinds with several firms at the same time. You only need to give your house details when, which conserves you time. Independent insurance representatives may likewise know which firms have the high qualities you're looking for, which will also conserve you time as well as could potentially save you cash.

Also if you switch over insurance coverage carriers, you can stick with the same insurance coverage representative. This can permit you to build a relationship with your independent insurance coverage agent no issue what company you choose for your insurance coverage policies. While captive representatives can likewise supply tailored client service, independent insurance coverage agents may be a lot more inspired to work hard to keep your service so you do not most likely to an additional agency.

If there is a concern with your insurance coverage, you can get in touch with your independent insurance policy agent to help settle your issue. On top of personalized customer support, an independent agent can use their knowledge of firms and also plans to steer you in the ideal instructions. A lot of independent insurance coverage agents function strictly on compensation, which implies they obtain paid a portion of the premium quantity for your insurance coverage.

Little Known Questions About Alfa Insurance - Jonathan Portillo Agency.

Independent insurance coverage firms can collaborate with all kinds of companies, ranging from smaller sized insurer to major ones, like Progressive as well as Nationwide. An independent representative might present you with an insurance quote from an unknown firm but one that still fulfills your demands as well as supplies the best insurance policy coverage for your family.

One advantage of working with a restricted agent is they are typically experts on the business they represent. This suggests they recognize the plan kinds, insurance coverages, available discount rates as well as how to obtain you the best deal with the insurance provider. Independent representatives collaborate with multiple insurance provider, so they might not be as experienced concerning each one and also their policy offerings.